what is my take home pay in indiana

If the average filer gets paid every other week that tax refund could have added 100 to each of. Also remember to subtract.

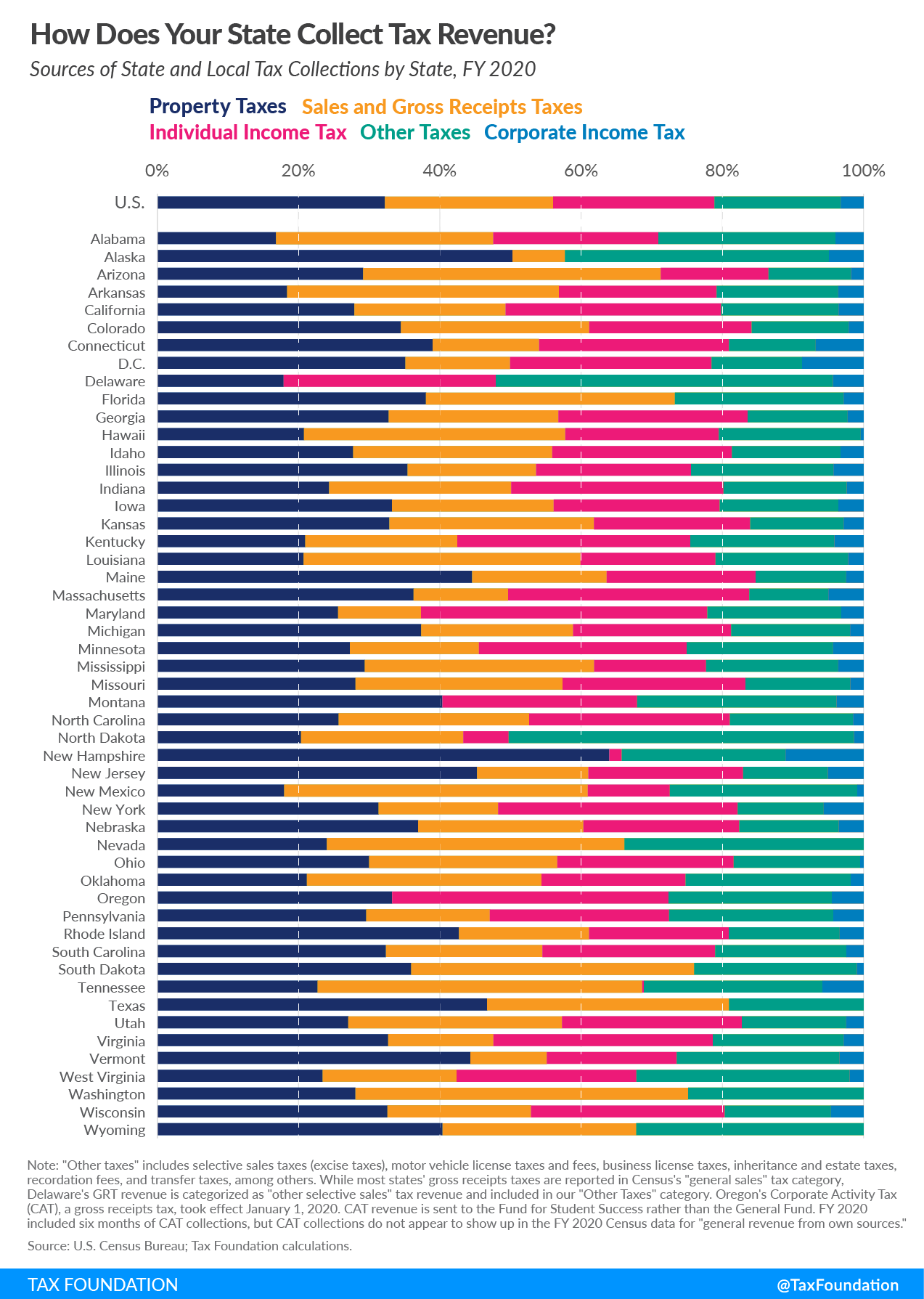

Indiana Tax Rates Rankings Indiana State Taxes Tax Foundation

7031 Koll Center Pkwy Pleasanton CA 94566.

. The take home pay is a term for the amount that you actually receive in your. People who own real property have to pay property taxes. 145962 The Sunshine State takes the crown when it comes to take-home pay with residents earning 200000 keeping a whopping 145962 tops in the.

To calculate your take-home pay follow these steps. You most likely wont pay tax on the sale of your home unless you have gains that are more than 250000 if youre single or more than 500000 if youre married and file jointly. With a rate of 323 percent starting with the first dollar Indiana residents earning 50000 can expect to take home just slightly below the national average pay of 39129.

The IRS reported that 2021 tax returns resulted in an average tax refund of 2815. State income tax swallows 676 of your 100K pay in the Golden State. Taxpayers can choose either itemized deductions or.

For example if you earn 2000week your annual income is calculated by. The top state income tax rate of. How much youre actually taxed depends on various factors such as your marital.

How to calculate take-home pay. Healthy Indiana Plan HIP 20 Influenza. Both the federal Fair Labor Standards Act FLSA and the Indiana Minimum Wage Law generally require employers to pay employees 1½ times their regular rate of pay overtime.

Your principal place of residence is the place where. The standard deduction dollar amount is 12950 for single. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

Supports hourly salary income and multiple pay frequencies. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck. Health State Department of.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. The federal income-tax ranges have shifted slightly for 2019 and the standard deduction will be 12200 for single filers and 24400 for married filers. Your take-home from a 100000 salary after federal and state taxes is just 68332.

The government uses the money that these taxes generate to pay for schools public. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Calculate your FICA taxes for the year.

In the chart below youll find the after-tax take-home pay for a 100000-a-year salary in the 25 largest US cities which we calculated using SmartAssets paycheck calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. Soldiers. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

140562 Residents in the Valley of the Sun enjoy a graduated state income tax system that helps keep overall tax rates low. You may be able to take a deduction of up to 2500 of the Indiana property taxes paid on your principal place of residence. Your take home pay is often different from the advertised payable salary that employers offer.

Veterans Home Indiana. First take your salary and subtract 4000 for each exemption you claim as well as your standard deduction amount as indicated in the table below.

Online Therapy Indiana 46077 Eddins Counseling Group

Dor Use Intime To Make Non Logged In Bill Payments

Senator Todd Young On Twitter My Statement Following President Trump S Tax Reform Speech In Indiana Https T Co Gx47k6fyqt Https T Co Syuxgghskk Twitter

Estimated Cost Of Attendance Cost Of Iu Paying For College Student Central Indiana University Bloomington

Via Credit Union Success Takes Direction

Dor Owe State Taxes Here Are Your Payment Options

Defense Finance Accounting Service Dfas

The Best Times Of My Life Home Town Memories From Vincennes Indiana By David Boyer Audiobook Audible Com

Indiana Teacher Pay Report Includes Dozens Of Recommendations Including 60k Average Salary Wthr Com

Savings Opportunities For Indiana Libraries Indiana State Library

Indiana String Art Indiana Decor State String Art Indiana Etsy

Indiana American Water We Keep Life Flowing

Kids Hammer At Home Wood Sign Take Home Kits Hammer And Stain Central Indiana